|

Real Estate Blog Thursday, April 09 2009

Although he is based in Los Angeles, CA, there will be several upcoming group sessions held in Austin. For more information, visit energyforsuccess.org. Monday, April 06 2009

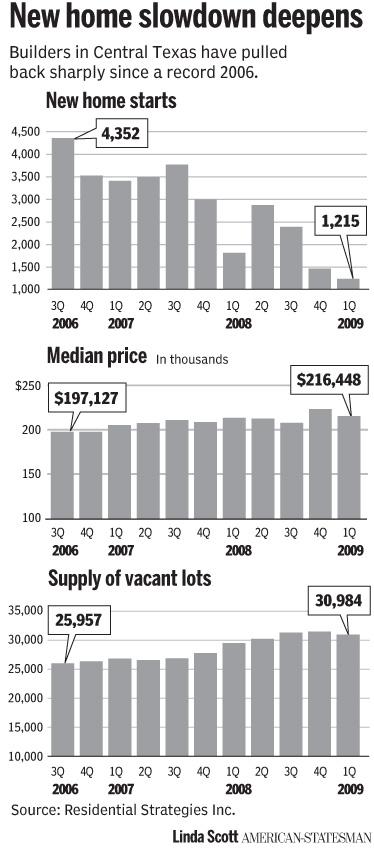

New home builders entered 2009 with the intent to sell their current inventory to help reduce the impact of a tightening economy. During the first quarter of 2009, there was a 47% decrease in new home construction starts compared to the first quarter of 2008. On 02 April 2009, The Austin American Statesman reported 1,215 homes were built in Jan- Mar 2009 compared with 2,297 homes built in Jan- Mar 2008. New home builders entered 2009 with the intent to sell their current inventory to help reduce the impact of a tightening economy. During the first quarter of 2009, there was a 47% decrease in new home construction starts compared to the first quarter of 2008. On 02 April 2009, The Austin American Statesman reported 1,215 homes were built in Jan- Mar 2009 compared with 2,297 homes built in Jan- Mar 2008. I've included the full-length article below for your enjoyment. Please feel free to contact Susie Kang at 512.480.8384 or at SusieKang@JoaRealty.com for more information regarding Austin new home sales. New home construction down 47%Fewer home starts may mean end to buyer incentives.

New home construction in Central Texas continued to slide in the first quarter of 2009, as builders started 47 percent fewer homes than in the same period in 2008, according to a new report. But builders are selling off their supply of homes, and the dwindling supply means incentives for buyers may wane, too, local housing experts say. In addition, they say that as homebuilders scale back on developing new lots to build on, parts of the region, especially those closer to the central city such as Circle C, could face a lot shortage as the economy rebounds. Builders started 1,215 homes from January through March compared with 2,297 a year earlier, according to a report issued Wednesday from market research firm Residential Strategies Inc. Builders are focusing on selling off their inventory, said Mark Sprague, Austin partner for Residential Strategies. Builders closed 2,145 sales, 31 percent fewer than a year earlier. Late last year, as bad economic news mounted, would-be buyers began cancelling orders at a higher rate. As a result, "builders entered 2009 with more finished inventory than they wanted," Sprague said. In 2008, new home construction in Central Texas plunged to its lowest level since 1997, with builders starting work on 8,987 houses. In 2006, they started 16,802 houses. Now, some builders have left the market, and others are winding down operations or are in bankruptcy. Despite the national housing downturn and recession, Central Texas' housing market has held up better than many around the country, local housing experts and regional economists say. Central Texas still is adding jobs, although at a slowing rate, as many other parts of the country are losing jobs. In addition, Sprague said there is not an oversupply of homes on the market. At the current sale pace, it would take 5.3 months to sell all the new homes on the market. A six-month supply is considered balanced. In the first quarter, the median price for a new home under construction in the Austin area was $216,448, up from $212,897 a year ago. Terry Mitchell, a local developer, said new home prices here remain stable because Austin's economy is still healthy. Also, the market is tightening, which could cause prices to rise, Mitchell said. Builders, particularly the big national companies with significant losses in other markets, don't have the capital to expand and aren't developing new lots or building new subdivisions, Mitchell said. "All that means is economics 101," Mitchell said. "When supply gets tight and demand remains the same, prices will go up." And with the latest figures showing nearly twice as many new homes sold as started, "this market may get tighter sooner than I imagined," Mitchell said, adding that some areas could face a shortage of lots and homes in a year to 18 months. Eldon Rude, director of the Austin office of With fewer homes for buyers to choose from, Rude said, "builders are less likely to offer the kinds of concessions that were necessary to attract buyers this time last year."

Wednesday, March 25 2009

Chairman of ABoR, Jay Gohil observes, "Compared to last month, we’re seeing the year-over-year gap begin to close on sales volume and hope consumer confidence will continue to rise to further spur the market...With unprecedented incentives available to homebuyers, such as an $8,000 first-time homebuyer tax credit and some of the lowest mortgage interest rates in history, we believe many Central Texans will recognize this spring as a great time to build wealth through Austin real estate.” Wednesday, March 18 2009

SXSW Film Festival Mar 13-21 Spend five days exploring the latest filmmaking innovations and trends. It is a great place to observe emerging talents from a wide array of types of films

SXSW Music and Media Conference Mar 18-Mar22 Hundreds of musicians from around the world greet fans at over eighty stages in downtown Austin in this 5-day conference. It’s not all about the concerts; during the day, registrants can attend the trade show at the Austin Convention Center full of informational sessions and panel discussions.

Downtown Ghost Tours Fris- Sats, 8pm Walk the streets of Austin and experience the popular ghost hotspots and learn about the history and geography of how this town came to be.

Austin Under the Stars: With 40 Telescopes 21 Mar 2009, 6pm This astronomical observation hosted by the Austin Astronomical Society and St Stephen’s Episcopal School is free and open to the public. Join local astronomers to view the Sun in daytime skies (special telescopes used, don’t try this at home)! Bring your lawn chairs and try something different this Saturday!

For more information about what Austin has to offer, please contact Susie at SusieKang@JoaRealty.com Wednesday, March 04 2009

On February 17, 2009, President Obama signed H.R. 1, the “American Recovery and Reinvestment Act of 2009”. The bill includes $787 billion in spending and tax cuts. Below is a list of investment and tax provisions that are of particular interest to the commercial real estate industry. IREM and CCIM legislative staff will continue to monitor the implementation of the provisions of the stimulus package and will keep you informed of the latest regulatory developments. I. Appropriations Provisions

COMMERCE · $4.7 billion for the Broadband Technology Opportunities Program to accelerate broadband deployment in underserved areas. · $650 million for additional implementation and administration of the Digital TV converter box coupon program.

ENERGY · $6.3 billion for energy efficiency grant programs, including $3.2 billion for the Energy and Conservation Block Grants administered by the Department of Energy and $3.1 billion for the State Energy Program. · $5 billion for the Weatherization Assistance Program. · $300 million for the Energy Efficient Appliance Rebate program and the Energy Star program. · $4.5 billion for Electricity Delivery and Energy Reliability to modernize and improve the electricity grid.

ENVIRONMENT · $200 million for the cleanup of leaking underground storage tanks. · $4 billion for the Clean Water State Revolving Funds. · $2 billion for the Drinking Water State Revolving Funds. · $100 million for Brownfields cleanup.

FEDERAL BUILDINGS · $4.5 billion to convert GSA facilities to High-Performance Green buildings.

HOUSING · $4 billion for the Public Housing Capital Fund which will assist public housing authorities in rehabilitating and retrofitting public housing units, including increasing the energy efficiency of units and making critical safety repairs. · $3 billion for Community Development Fund, including $1 billion for the Community Development Block Grant program and $2 billion for the Neighborhood Stabilization Program. The Neighborhood Stabilization Program funding will assist states, local governments and nonprofits in the purchase and rehabilitation of foreclosed, vacant properties in order to create more affordable housing and reduce neighborhood blight. · $2.25 billion for the Home Investment Partnerships Programs which provides funds to state housing credit agencies for capital investments in low-income housing tax credit project. · $2.25 billion for Assisted Housing Stability and Energy and Green Retrofit Investments, including $2 billion available to property owners for rental assistance and $250 million for grants or loans for energy and green retrofit investments. · $100 million to local governments and nonprofit organizations for removal of lead-based paint hazards in low-income housing.

RURAL DEVELOPMENT · $1.38 billion additional funding for the Rural Utilities Service loans and grants for water and waste disposal facilities. · $130 million additional funding for loans and grants for essential rural community facilities including hospitals, health clinics, health and safety vehicles and equipment, public buildings, and child and elder care facilities.

TRANSPORTATION · $48 billion for transportation-related infrastructure projects including highway and bridge construction; transit new construction, upgrades and repairs; and high spee d rail corridors. II. Tax Provisions

TAX INCENTIVES FOR INDIVIDUALS · Extension of AMT relief for 2009. Provides more than 26 million families with tax relief in 2009 by extending AMT relief for nonrefundable personal credits and increasing the AMT exemption amount to $70,950 for joint filers and $46,700 for individuals.

TAX INCENTIVES FOR BUSINESSES · 5-Year Carryback on Net Operating Losses for Small Businesses. Under current law, net operating losses (“NOLs”) may be carried back to the two taxable years before the year that the loss arises (the “NOL carryback period”) and carried forward to each of the succeeding twenty taxable years after the year that the loss arises. For 2008, the legislation extends the maximum NOL carryback period from two years to five years for small businesses with gross receipts of $15 million or less. · Extension of Increased Small Business Expensing. Last year, Congress temporarily increased the amount that small businesses could write-off for capital expenditures incurred in 2008 to $250,000 and increased the phase-out threshold for 2008 to $800,000. This provision extends these temporary increases for capital expenditures incurred in 2009. · Small Business Capital Gains Exclusion. This provision allows a 75% exclusion for individuals on the gain from the sale of certain small business stock held for more than five years. This change is for stock issued after the date of enactment and before January 1, 2011. · Extension of bonus depreciation. Last year, Congress temporarily allowed businesses to recover the costs of capital expenditures made in 2008 faster than the ordinary depreciation schedule would allow by permitting these businesses to immediately write-off 50% of the cost of depreciable property acquired in 2008 for the use in the United States. This provision extends this temporary benefit for capital expenditures incurred in 2009. · Cancellation of Debt Income. This section provides tax relief for businesses that reacquire, satisfy or otherwise discharge debt obligations at a discount in 2009 and 2010. The law permits businesses to defer any tax on 2009 and 2010 cancellation of debt income until 2014. The new provision then taxes that cancellation of debt income ratably over the following five years (2014 – 2018). · Temporary Reduction Period for S Corporation Built-In Gains. This provision temporarily reduces the holding period from ten years to seven years for sales occurring in 2009 and 2010. ENERGY TAX INCENTIVES · Extension of the renewable electricity production credit. Extends for three years the period during which qualified facilities producing certain renewable electricity may be placed in service for purposes of the electricity production credit. · Issuance of new clean renewable energy bonds. Provides $1.6 billion in new clean renewable energy bonds (CREBs) that may be issued by qualified issuers (public power providers, cooperative electric companies, etc.) to finance qualified renewable energy facilities. · Repeal of limitations on credit for renewable energy property. Eliminates the credit cap applicable to qualified small wind energy property. Also removes the rule that reduces the basis of the property for purposes of claiming the credit if the property is financed in whole or in part by subsidized energy financing or with proceed from private activity bonds.

Treasury Department’s Financial Stability Plan Separate from the Stimulus Package, the Treasury Department recently announced a multi-pronged program intended to help lay the groundwork for restoring the flows of credit to households and businesses. However, at this time the Treasury Department has offered limited details regarding this plan. More details will be provided once they are released by the Treasury Department. Listed below are major components of the plan: · Expand the existing Term Asset-Backed Securities Lending Facility (TALF) from $200 billion to as much as $1 trillion in order to restart the securitized credit markets that in recent years supported a substantial portion of lending to households, students, small businesses, and others. TALF would also expand to include commercial mortgage-backed securities (CMBS). TALF combines capital provided by the TARP with funding from the Federal Reserve in order to promote lending by increasing investor demand for securitized loans. · A Public Private Investment Fund, jointly run by the Treasury and the Federal Reserve, with financing from private investors, to buy up hard-to-sell assets that have bogged down banks and financial institutions for the past year. Treasury Secretary Geithner said the new fund, often described as a “bad bank” for holding toxic assets, would start with $500 billion with a goal of eventually buying up to $1 trillion in assets. · Direct capital injections into banks, using funds from the remaining $350 billion from the Troubled Asset Relief Program (TARP), passed last year by the Bush Administration. · An Extension of the FDIC’s Temporary Liquidity Guarantee Program to October 31, 2009. This program is intended to provide more liquidity to banks and financial institutions. · A new framework of governance and oversight to help ensure that banks receiving funds are held responsible for appropriate use of those funds through stronger conditions on lending, dividends, and executive compensation along with enhanced reporting to the public. Sunday, February 15 2009

Here are some highlights of the stimulus package relating to real estate: · Refundable First-Time Home Buyer Credit: Homes bought after January 1, 2009 are not required to repay the 10% of home purchase price tax credit granted by Congress last year. Also, the limit of the tax credit was increased from $7,500 to $8,000 · Tax Credits for Energy-Efficient Improvements to Existing Homes: Extends tax credits for improvements to energy-efficient existing homes through 2010. The tax credit can qualify homeowners to receive tax credits up to 30% (previously, it was 10%) To discuss how the economic stimulus package will help you and your real estate dreams, please contact Susie at SusieKang@JoaRealty.comMonday, February 02 2009

2008 definitely showed a decline in the numbers of homes sold but the stability in the Austin real estate market is highlighted in its median price. While most cities saw a decline in median home prices, Austin produced a 2% increase. 2008 definitely showed a decline in the numbers of homes sold but the stability in the Austin real estate market is highlighted in its median price. While most cities saw a decline in median home prices, Austin produced a 2% increase. According to the Austin Board of Realtors®, here were the year-end totals for 2008:

For an in-depth look at Austin's Real Estate market for 2008, please review the Gracy Title 2008 Year In Review- MLS Area Statistics attachment . Monday, January 26 2009

ABoR Chairman, Jay Gohil, reveals, “ For more detailed information, please reference: December 2008 Austin MLS Areas Report December 2008 Austin MLS Regions Report December 2008 Austin MLS Indicators Report For more information about home values in Austin, please contact SusieKang@JoaRealty.com or call 512.480.8384 Sunday, January 18 2009

With stores like Linens N Things and Circuit City shutting doors, it is refreshing news to hear of retailers expanding their locations and/or establishing roots in Austin. The following companies are currently planning expansions in Austin: With stores like Linens N Things and Circuit City shutting doors, it is refreshing news to hear of retailers expanding their locations and/or establishing roots in Austin. The following companies are currently planning expansions in Austin:

There have been no announcements of major retail construction set for 2009, so the new store openings will help offset the store closures of other retailers. For more information on commercial real estate, please contact Susie at SusieKang@JoaRealty.com. Tuesday, January 06 2009

Jay Gohil, ABOR chairman observes, "There is no denying the Austin market has begun to slow...However, we still enjoy strong statewide job growth and low unemployment, two factors missing in other, more challenged parts of the country. These sound fundamentals, combined with capital that should flow more freely to homeowners from the recent federal bailout, will put Austin in good stead as the market begins to recover." |

|

Visit SusieKang.com for Korean site |

Texas Real Estate Commission Information About Brokerage Services | Texas Real Estate Commission Consumer Notice

Copyright© 2012 - Susie Kang. All Rights Reserved.| Site Designed By Dara's Design

a housing research firm, said the Austin area "is moving toward some of the lowest new home inventory levels we have seen in our market in the last 10 years."

a housing research firm, said the Austin area "is moving toward some of the lowest new home inventory levels we have seen in our market in the last 10 years."  The

The  Welcome to all the people who are in town for the annual

Welcome to all the people who are in town for the annual

On Tuesday 17 Feb 2009,

On Tuesday 17 Feb 2009,